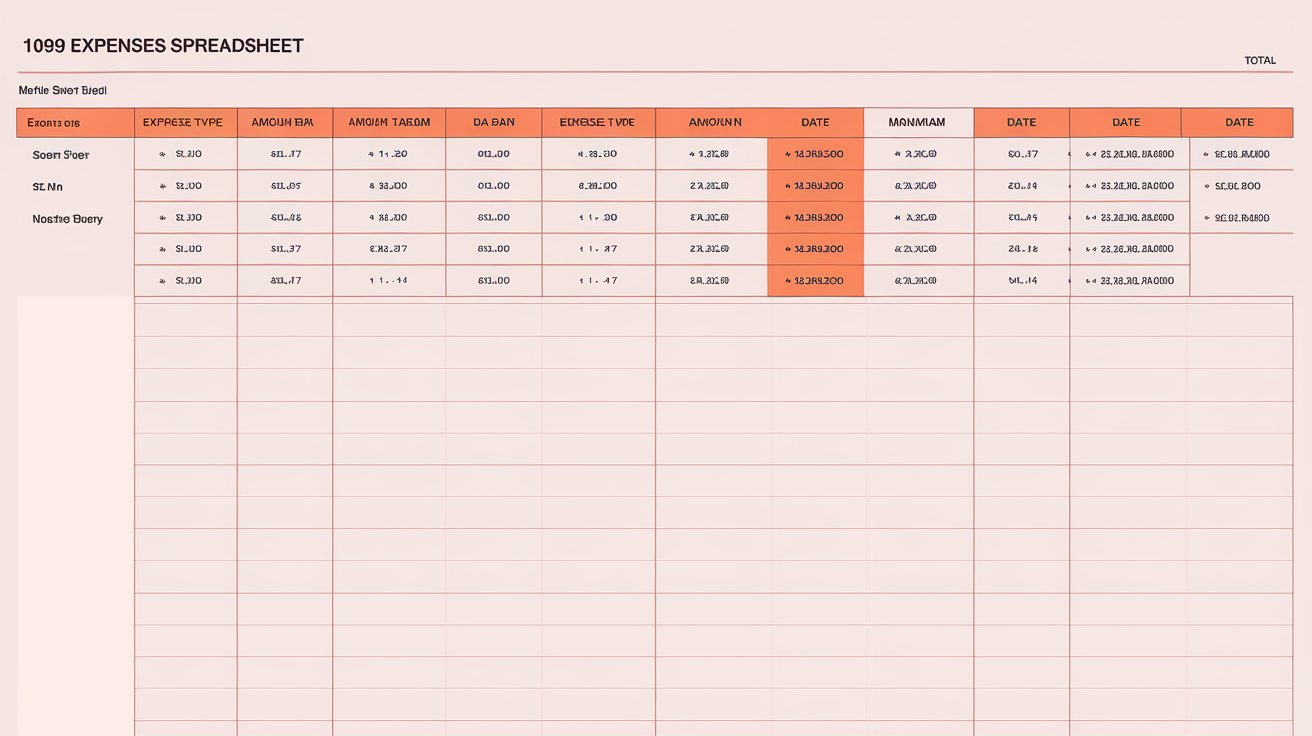

Understanding the 1099 Expenses Spreadsheet

Purpose of the spreadsheet

A 1099 expenses spreadsheet is an essential tool for independent contractors to track their income and expenses throughout the tax year. This spreadsheet serves multiple purposes, including calculating potential tax deductions, organizing business expenses, and simplifying the annual tax filing process. By accurately tracking your expenses, you can ensure that you take full advantage of available tax deductions that minimize your taxable income.

Read More: How To Use Expenseit

Importance for independent contractors

For independent contractors, every dollar saved on taxes can significantly impact your overall profitability. Many individuals earning income through 1099 forms overlook potential deductions simply due to poor record-keeping practices. A well-maintained 1099 expenses spreadsheet allows you to systematically catalog your business-related expenses, making it easier to identify eligible tax deductions when it’s time to file.

Features of a good spreadsheet

A good 1099 expenses spreadsheet should include several key features. It must be easy to navigate, with clearly defined expense categories mirroring IRS requirements. The spreadsheet should also allow for easy data entry, provide automated calculations for deductions, and include summaries that give you an overview of your financial situation.

Additionally, having tabs or sections dedicated to various types of expenses is critical for organization and quick reference.

Setting Up Your 1099 Expenses Spreadsheet

Choosing a platform (Excel/Google Sheets)

When it comes to selecting a platform for your 1099 expenses spreadsheet, you can choose between Microsoft Excel and Google Sheets. Both tools are capable of handling the necessary calculations and formatting, but they have distinct advantages. Excel offers robust features for those familiar with complex spreadsheet functions, while Google Sheets provides the advantage of easy sharing and collaborating in real time. Consider your comfort with each platform before making a decision.

Template options available

There are several ready-made templates that you can use to simplify setup. Look for options that specifically cater to 1099 workers, as they will already include many of the necessary categories and calculations. Search online for “best spreadsheet templates for 1099 workers” to find various free templates. Some reputable sources include Keeper and Bonsai, which offer useful layouts designed for tracking freelance income and expenses accurately.

Customizing your spreadsheet

Once you have chosen a template or set up a blank spreadsheet, customization can enhance its functionality. Add or modify categories to reflect the unique nature of your work.

For instance, you might want to include sections for travel expenses, equipment purchases, or software subscriptions. Take advantage of color coding or conditional formatting to make your spreadsheet more visually organized, helping you quickly locate different expense types.

Organizing Expense Categories

Key Schedule C categories

It’s essential to develop a clear categorization system on your 1099 expenses spreadsheet. Referring to IRS Schedule C, categorize your expenses into sections like advertising, contract labor, travel, meals, and home office expenses. Understanding which categories are relevant can save you significant amounts of money in deductions over the long run.

Creating worksheet tabs

Creating separate tabs for different aspects of your finances can streamline your record-keeping process. Consider having specific tabs for income tracking, various expense categories, and a summary tab that provides an overview of your financial state at a glance.

For instance, your main expenses tab could dive deeper into types such as equipment expenses, software subscriptions, or marketing costs.

Inputting expenses and data

Regularly input your expenses into the appropriate tabs and categories to avoid the rush of entering a year’s worth of data at tax time. Make it a habit to log expenses as they occur, including merchant names, dates, and amounts. This routine not only helps you stay organized but also reduces the stress associated with tax preparation during peak filing season.

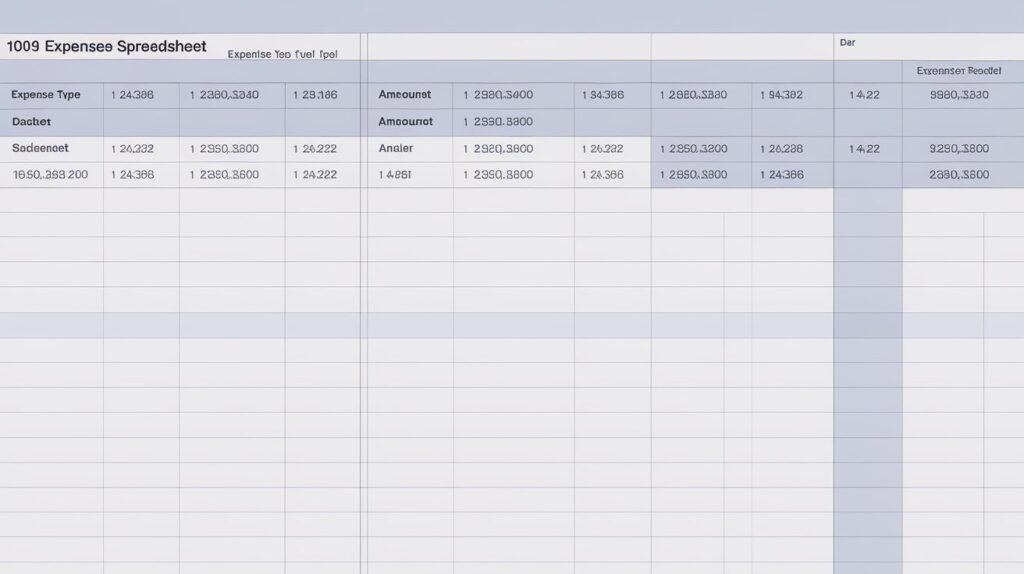

Automating Calculations

Using formulas for deductions

One of the greatest advantages of using a 1099 expenses spreadsheet is its ability to automate calculations. Use formulas to compute total expenses per category, as well as your overall deductions. By setting formulas, your spreadsheet updates automatically as you input data, ensuring you always have the most current information.

Tracking expenses efficiently

To track freelance income and expenses effectively, ensure that you integrate your formulas properly.

For example, summing ranges of expenses will show total amounts per category at a glance. Including a line for total potential deductions will help you visualize how much you might save on your taxes.

Summary rows and totals

It’s beneficial to include summary rows that automatically calculate your total expenses and estimated tax deductions. This provides an instant snapshot of your financial situation, making it easier to manage your budget as well as plan for future expenses. Setting up a ‘Summary’ tab displaying total income, total expenses, and calculated deductions can greatly enhance your financial planning.

FAQs

What is a 1099 expenses spreadsheet?

A 1099 expenses spreadsheet is a tool independent contractors use to record and categorize business expenses that may be deductible on their tax returns, specifically for income received via 1099 forms.

How can I track my deductible expenses?

You can track deductible expenses using a dedicated spreadsheet where you categorize every business-related expense, input essential details like date and merchant, and automate calculations to determine potential deductions.

What categories should I include in my spreadsheet?

Key categories to include in your spreadsheet mirror IRS Schedule C, such as advertising, contract labor, travel, meals, and home office expenses. Additional custom categories may be added based on your unique business needs.

How does this spreadsheet simplify tax filing?

By organizing expenses and automating calculations, a 1099 expenses spreadsheet lets you quickly see all your deductions before filing taxes, minimizing the risk of missing potential write-offs and making the entire process more organized and efficient.

How to keep track of expenses for 1099?

Establish a routine of logging expenses into the spreadsheet as they occur, ensuring all relevant details are recorded. Regular updates and consistent categorization form the backbone for effective tracking.

Is there a 1099 template in Excel?

Yes, many free 1099 templates are available in Excel or Google Sheets to help you easily track your income and expenses, such as those provided by Keeper, Bonsai, and other online platforms.

Can I write off expenses if I get a 1099?

Yes, you can write off qualifying business expenses even if you receive a 1099. It’s essential to track these expenses accurately to ensure you claim all deductions available during tax filing.

Reference On 1099 Expenses Spreadsheet

- Independent Contractor Expenses Spreadsheet [Free Template]

- The Ultimate Guide to Your 1099 Expense Tracker Spreadsheet

- Track business expenses with Excel | Learn at Microsoft Create

- Free 1099 Template Excel (With Step-By-Step Instructions!) – Bonsai

- Tax Deductions Template for Freelancers – Google Docs